Best ways to get out of debt

Debt by it’s very definition means something owed. We wanted to get out of debt so that we wouldn’t owe anyone anything. Our money should be working in our favor and not be sent to other companies/people/collectors. We always want to pay the price for something – not the price plus INTEREST.

While we were in debt, there was always a lingering fear that something terrible would happen, that would stop our income. If we didn’t have any income, we wouldn’t be able to pay our debts. Being completely out of debt takes that fear away!

What would it look like to have no payments?

Let’s take it a step further. If you didn’t owe anything on student loans or personal loans, how much money would that free up for you in a month? What about if you no longer had car payments or owed anything on a credit card? If you want to get especially intense, how much money would you free up each month if you didn’t have a HOUSE payment?

No matter your stance on debt, you have to admit that having that much money freed up month after month could do amazing things for your family! Let’s talk about how you can make that happen!

The best way to get out of debt

The best (and most obvious) way to get out of debt is to bring in more money to throw at the debt. That part is basic math, but sometimes it’s hard to know what to do to find that extra cash. Here are some ideas:

“Sell so much stuff the kids think they’re next”

Our favorite getting out of debt quote is from Dave Ramsey, “Sell so much stuff the kids think they’re next!”. There’s no doubt that we all have extra things lying around the house that we don’t actually use or need (like the seemingly millions of suitcases and bags we had lying around). It’s time to clean out the house and make some money off of all that stuff!

Post it on Craigslist or Facebook for sale groups! Have a garage sale or yard sale! Bring it to a consignment or pawn shop! If it isn’t being used, take that cash and put it to use right now. What starts as a few dollars here and there can really add up quickly if you stay focused, and keep paring down the things you don’t actually need or use.

Time to Get a Gig

The idea of a “part time gig” or “side hustle” can bring up the spammy notions, at least for me. The social media ‘Hey girl’ messages from that girl you met that one time at that one place.

There are lots of part-time options out there that fall in the Direct Sales or MLM realm, and many are valid opportunities! Just be sure to do your research and learn how to sell and recruit in not spammy ways!

However, if that’s not your cup of tea, taking another more traditional job can increase your income to help give you a bigger shovel to dig yourself out of debt with. There are many options out there from childcare to retail, or up and coming jobs like driving for a food delivery service or grocery shopping for someone else!

As you’re looking for opportunities outside your regular job, don’t forget to look WITHIN your job for things like promotions, raises, and overtime that can help you reach your goal of getting out of debt.

Cut Costs

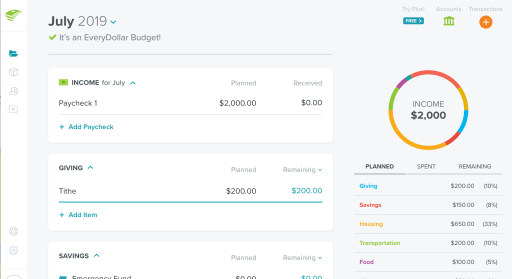

It’s time to make a budget. And I’m talking a real, plan-where-your-money-will-go budget, not a look-where-it-went method of “tracking expenses”. There are lots of free, easy ways to do this. We have regularly used YouNeedABudget and EveryDollar, both of which do a great job! See where you are overspending and cut costs where you can. Many people find that they are spending a lot on impulse buys (Hello, Target!), groceries, and other miscellaneous things that sneak into the budget unexpectedly. Other times, the issue is simply not planning ahead for things. Either way, take a look at your budget and see where you can clean things up a bit.

If you’re really intense about getting out of debt, see if there are things you can cut all together for a short time while you get out of debt. Some suggestions would be cutting the travel fund for a while, cutting cable, and cancelling all subscriptions to save some money for a short time. And who knows, maybe you’ll learn that you can cut some things for good!

There are other options to help you save money too. One of the best things you can do is use what you have! This might mean eating things that you already have on hand before you grocery shop. It could also mean swapping date nights with a couple where you watch their kids while they go out and they watch yours while you get a night out!

Get yourself out of debt for good!

While it can be discouraging at times, getting out of debt is one of the best things that you can do for yourself and your future. Once you feel the freedom of being able to decide what to do with your money, it will change how you interact with money for good. We are so happy to be done with debt and moving forward in freedom! What could you do with all the money you save by ditching your payments completely?